Why Financial Literacy is Essential for UCP Students?

Finance is one of the primary aspects of human life. All life struggles move around it—education, jobs, business, career development, family expenses, day-to-day expenditure, functions, and retirement matters. Therefore, we all must know how to handle money. UCP brings a thorough article on financial literacy for the UCP students. It is essential to learn the skill of money management.

What is Financial Literacy?

Financial Literacy is a mandatory skill to learn for everyone. However, it has never been formally taught anywhere in Pakistan. Therefore, we have a very minimal number of people who are financially literate and good with money.

The situation is not very different in the developed countries. The data available online discloses that around 66 per cent of the population is considered financially illiterate. Therefore, they often get stuck in financial burdens and problems.

However, the good news is that, like any other soft skill, you and I can learn financial literacy with regular efforts. To learn this major life skill, the essential element is to understand the financial setup of a country.

For example, the financial options work in the US are not feasible and commonly available in Pakistan. Therefore, if you a Pakistani resident, you must learn the function of Pakistani financial and monetary matters.

Financial Literacy in Pakistan

In Pakistan, the phenomenon of financial literacy is considered low in comparison to the international standards. The majority of people lack the basic financial understanding and practices. According to the data, the state of financial literacy in Pakistan is as follows.

- Only 26% people out of the 180 million population are considered financially literate.

- Many people lack the understanding of financial products and skills like budgeting, investing, and saving.

- Like other major concepts, there is a wide and visible disparity of financial options and financial literacy among the male and female population of Pakistan.

Males have more open, easy access to financial decision-making. This factor is like the level of education in the country.

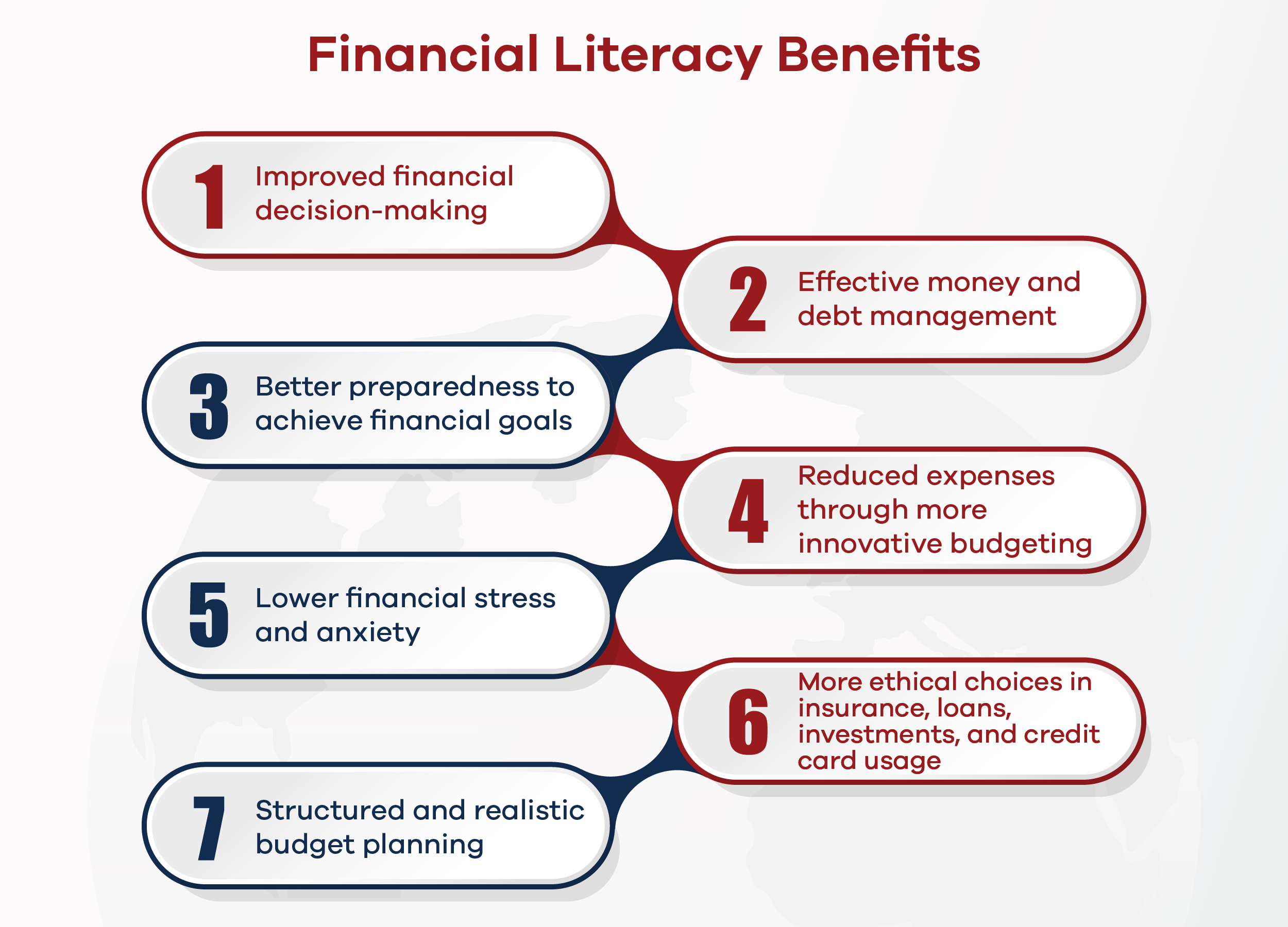

Benefits of Financial Literacy

The sad situation is eye-opening. However, before deciding to spread financial literacy in Pakistan, it is important to know what advantages you can get if you are financially educated.

Financial literacy helps you in

- Improved financial decision-making

- Effective money and debt management

- Better preparedness to achieve financial goals

- Reduced expenses through smarter budgeting

- Lower financial stress and anxiety

- More ethical choices in insurance, loans, investments, and credit card usage

- Structured and realistic budget planning

However, to attain all these benefits, one must be aware of the core concepts of financial literacy. Before you know how to handle it the best way, it is essential what tool to use.

Fundamentals of Financial Literacy

- Earning

- Spending

- Saving

The money matters revolve around these three major components. What is the source of your earnings, where are you spending, and how much amount you save regularly? The entire concept of financial literacy revolves around these three questions. In the details of these questions, there come the elements as follows.

- Budgeting

- Investing

- Borrowing

- Taxation

- Personal Financial Management

Practice Financial Literacy in Student Life

Though the fundamental concepts of financial awareness are the same globally. Yet, the financial models and practices are different across the globe. Therefore, students in Pakistan should have a financial knowledge of the national financial system, options, and possibilities.

Students in universities in Pakistan should practice financial literacy. To get the most out of it, the students must focus on the first step—money generation.

In Pakistan, the students are mostly free from the elements of student loans and educational debts. Therefore, the students in Pakistan have leverage not to pay off the student loans. Let’s see in the following why a Pakistani student should get financial literacy. And how they can attain one!

What Can a Student in a Pakistani University Do?

The financial system in the country is different from the rest of the world. Therefore, if you are studying in any university in Pakistan, take UCP for example. You must learn about the following things while you are still in the undergraduate and graduate years. In this way, you will gain reasonable financial literacy, and it will be smooth for you to move forward in life.

Identify Multiple Sources of Earning

A stable income is the first step towards financial freedom. In Pakistan, there are three possible sources of income. As a student, you can either start freelancing, online stores, and local gigs like tutoring, or event management. Once you graduate, you can either join the government sector or a private organisation for your career development.

An ideal money generation scenario is the ability to earn from diverse activities. Therefore, explore your options and try to incorporate multiple options as your legit sources of income.

Manage Your Expenses

The next step is effective expense management. You need to control your spending and try the tools for budget allocation. In this way, you will be able to manage your lifestyle more independently. Try to avoid the extra expenses and money waste.

Save & Invest

Once you save any amount, try to invest it for money generation. You can start from small savings. Here you must maintain two funds for your future.

- Emergency Funds

- Need-Based Funds

This will all be done under budgeting. Follow the ratio that suits your needs and requirements. For example, you can save in 50-30-20 ratio. Divide 50% of your total income into necessities, around 30% into your savings, and around 20% of your fund into lifestyle or enjoyment.

Taxation

When you earn, invest, or make assets, it is important that you are well aware of the taxation laws in your country. This case applies to all financial activities, like freelance, job, business, or investment. Tax applies to everything.

The key to financial literacy is to understand how to earn and how to manage spending with more money. It is also an important factor to manage your emotions, fears, and anxiety to make the right decision.

Conclusion

Financial literacy is important for everyone to navigate successfully through the financial journey. In Pakistan, the ratio of financial literacy is too low. It is high time to start practicing your financial awareness from university years.